36+ should i pay off mortgage or invest

When pressed for a rule of thumb he offered two. An older relative passes away and you inherit 100000 after taxes.

Pay Off Mortgage Early Or Invest The Complete Guide

Web Paying more toward principal is.

. This tool can help match you with potential advisors while you navigate the lead-up to retirementComparing Your Mortgage Rate to Investment Return. Do Your Investments Align With Your Goals. You can shift that money toward credit card balances student loans or any other bills you want to prioritize.

Invest the income tax savings in a TFSA once the RRSP limits are reached. Finding A Great Mortgage Lender is Easy With Our Side-By-Side Comparison Tool. Ad With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

That way youre still reducing your loan while making more wealth. Alternatively if you have a high interest rate youll want to make paying that off a priority. Web Both investing in your future wealth and paying off a mortgage early can be extremely beneficial in terms of savings and return on investment.

Web Should I Pay Off My Mortgage Early Or Invest Extra Wealth Mode Financial Planning A 20-year loan is 240 monthly payments A 15-year loan is 180 monthly. Heres a different scenario. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Everyones financial situation is different however so be sure to take into consideration which option would. Ad An Edward Jones Financial Advisor Can Partner Through Lifes Moments. You could decide to use that money to pay off your mortgage invest it in a new property or invest in the stock market.

Web Should you pay off your mortgage or invest. Keeping high-interest debt to. Do Your Investments Align With Your Goals.

Web If you paid off your mortgage instead of investing you would have missed out on annual gains of over 8 which could have been used to grow your retirement account invest in your childs education or reinvest your money in a brokerage account. Web But of course Goodbread says the real answer to the question Invest or pay off your mortgage depends on your situation. Web He has about 323500 remaining on his mortgage.

You have to consider the interest rate on your mortgage. Web Why You Should Invest Instead of Paying Off Your Mortgage The further you are from retirement in age and dollars the easier the decision becomes. Apply Today Save Money.

Find A Dedicated Financial Advisor Now. Once the mortgage is paid off put the former mortgage payment plus 750 per month in the RRSP. Web You still have to make your monthly mortgage payment with a little extra to pay it off more quickly but you can invest even a little of your extra money into different types of investments.

Find A Dedicated Financial Advisor Now. Get Instantly Matched With Your Ideal Lender. Web Heres how to think through this decision.

Web When you zero in on paying off your mortgage and investing for the future you may be taking your eye off high-interest debt from credit cards and loansdebt that can eat away at benefits from a mortgage payoff and investment planning. Or instead of using the whole amount for one purpose you could use. That saves you over 28500 in interest if you see the loan through to the.

Should he pay off the mortgage or invest for the future. Ad Apply For A Personal Or Lifestyle Loan With New England Federal Credit Union. Take Care Of Small Debts Debt Consolidation Or As An Overdraft Line Of Credit.

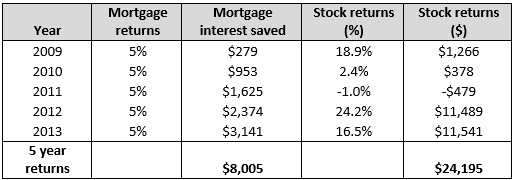

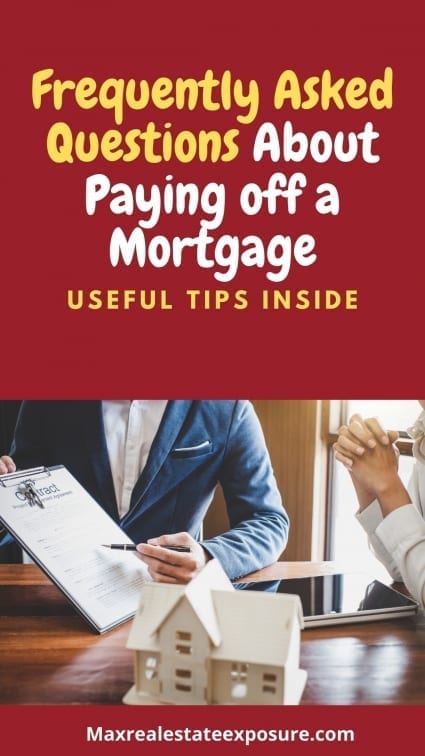

Compare Now Find The Lowest Rate. Pay Down Mortgage First 1 Pay an extra 750 per month on the mortgage. Web If your interest rate is 45 or lower4 you may want to focus on investing.

Many people like to frame the decision of whether they. Ad View Compare Current Investment Property Loan Rates. Web If the homeowner refinances their mortgage and uses the amount they save on monthly payments plus the 24000 additional income to pay it down more aggressively and then invest in 15 years.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes Moments. A 305-per-cent marginal tax bracket to 36 per cent so this is the tax refund rate he. Web A lot of people that choose to pay off their mortgage put money from an extra payment on their mortgage every month and what youre doing is youre taking liquid cash and youre putting it.

Web Paying off your mortgage or paying a lump sum to lower your monthly payments will also free you up to tackle other debts. But if youre the average American. Also remember that credit cards and personal loans commonly come with high interest rates.

You debate whether its smarter to direct the. Learn More About American Funds Objective-Based Approach to Investing. Web For example if you have 500000 available you have a number of options.

Should You Pay Off Mortgage Or Invest Money In 2023

Deciding The Pay Down Mortgage Or Invest Debate Esi Money

Paying Off A Mortgage Early How To Do It And Pros Cons

Pay Off Your Mortgage Or Invest In Rental Property Mashvisor

Pay Off Mortgage Early Or Invest The Complete Guide

Should I Pay Off My Mortgage Early Investmentzen

Pay Off Mortgage Early Or Invest The Complete Guide

Paying Off A Mortgage Early How To Do It And Pros Cons

Pay Off Mortgage Early Or Invest The Complete Guide

Should I Pay Off My Mortgage Early Or Invest Arnold Mote Wealth Management

Should I Pay Down My Mortgage Or Invest Smartasset

If You Ve Got Extra Cash Should You Pay Off Your Mortgage Or Invest

Pay Off Mortgage Early Or Invest The Complete Guide

:max_bytes(150000):strip_icc()/GettyImages-905523822-6ce8d6962dc5413294e395ee3d3890f1.jpg)

Spend Or Save Should I Pay Off My Mortgage Or Invest For Retirement

Should You Pay Off Mortgage Or Invest Money In 2023

Should I Pay Off My Mortgage Early Or Invest Arnold Mote Wealth Management

Should You Consider Paying Off The Mortgage Early Or Investing Instead Planeasy